The Impact of Lockdown

In times of such insecurity, it is a shame that nobody in our industry has that elusive crystal ball. What we do have available is big data, and this data is invaluable in quantifying the impact this vast uncertainty has had on “normal” business trading for the South African hospitality sector. We all know, and we all can see clearly, the undeniable havoc that COVID-19 has caused to most in our industry. The ongoing amendments to the lockdown regulations in South Africa for well over a year, has once again threatened to decimate the sector further in the coming weeks.

The new lock down measures declared by President Ramaphosa on Sunday evening feels somewhat familiar. They are very much akin to the lock down imposed over the December 2020 period although some would argue that it may well be much stricter. During the December 2020 lock down and associated ban on alcohol sales, the industry witnessed a massive increase in the number of cancellations, and this had a direct impact on the growth trajectory for the sector as it began to slowly recovery from the initial hard shut down in early 2020.

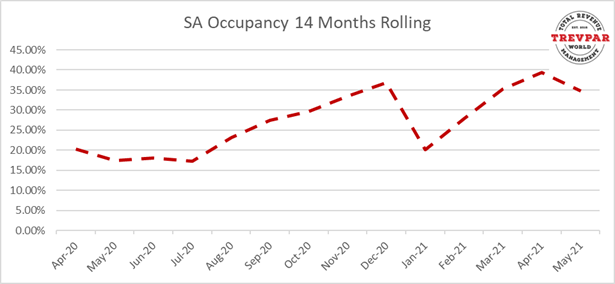

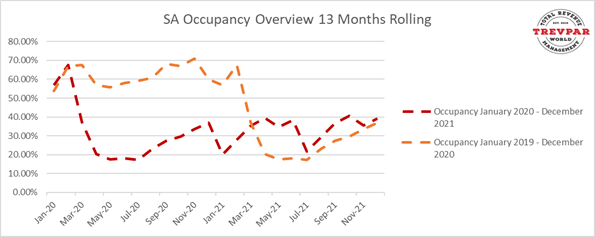

When looking at the rolling occupancies for South Africa from April 2020, one can see that average occupancies were low, however climbing steadily towards a potentially decent Festive Season for the sector. The announcement of the lock down measures in December 2020 resulted in an immediate decline in occupancies across South Africa and this was felt well into January 2021.

Once the lock down was lifted, a positive upward trend in occupancy can be once again noted, showing the direct correlation of the lock down measures on the ability of the sector to generate reservations and revenue. Since the lifting of the previous lock down an average month on month increase in occupancy of 3.3% can be seen.

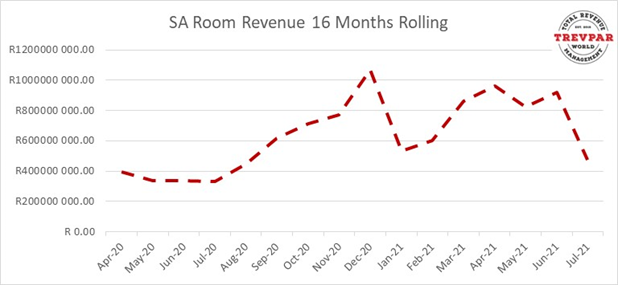

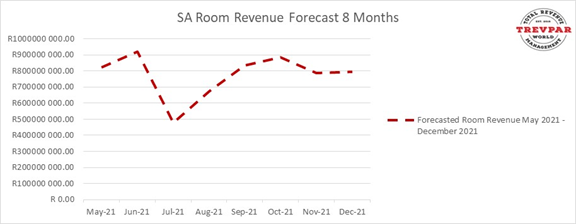

When reviewing room revenue, a similar trend can be observed. The value of a 3.3% average occupancy growth each month equates to R121million per month more generated by the industry. This much needed revenue injection saw many operators, gearing more aggressively for a more positive year in 2021.

The lock down in December 2020 caused a direct decrease in occupancies for the following month of 16.70%, this resulted in a month on month decrease in room revenue generated of R535 million.

The events of Sunday night, subsequent changes to the lock down level and related regulations, can be regarded as far more severe than the previous lock downs. However, based on what we have learnt from the December 2020 impact, an anticipated decline of occupancy in July 2021 of in the region of 16.80% is to be expected. This will result in an approximate month on month decline in room revenue of R442 million for the hospitality sector.

When aggregating the direct loss of room revenue as a result of the December 2020 lock down regulations on the sector, coupled to the potential losses in room revenue as a direct result our current lockdown, its projected that these actions will lead to an estimated R977 million loss in room revenue alone.

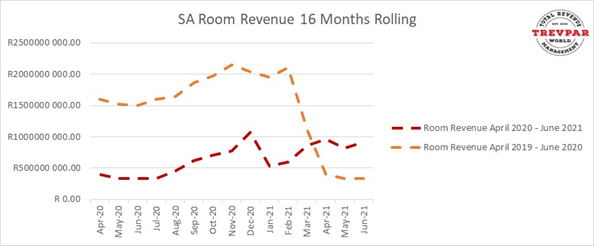

When comparing the last 16 months to the room revenue actuals over the same period in 2019, its paints a dreadful picture. A total decline of 56.72% in room revenue for the comparable periods is evident. This quantifies just how catastrophic COVID-19 has been on the industry, our livelihoods and the economy at large.

The long road to recovery – the data crystal ball

Based on the current lock down regulations, as well as factors such as the slow roll out of vaccinations in South Africa, restricted inbound international travel and limited business travel, it is very clear that the recovery from our current lock down will be slow and follow a similar trend to before. Our only hope is that we see an influx of fully vaccinated international travel returning soon to help boost the recovery trajectory.

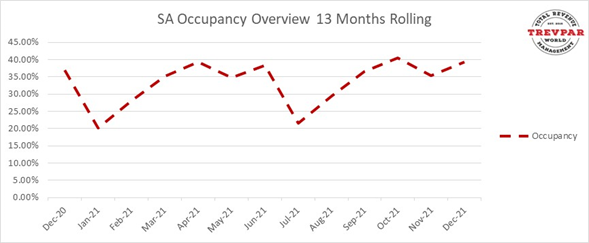

When reviewing the probable occupancy trends for the remainder of the 2021 calendar year, it is highly likely to be a similar trend to what was experience previously, however it is anticipated that this recovery may well be at a lesser average daily rate (ADR). This forfeiture of rate is largely due to a greater number of properties open and trading when compared to six months ago, and this has created highly competitive market pricing to secure more of the domestic market share and has driven ADR downwards.

Based on historical data, all trends are showing that expected recovery from our current trading restrictions will be steady, positive and will peak again in December 2021 for the Festive season, however when compared to 2019 and 2020 occupancies, the recovery is still a long way off.

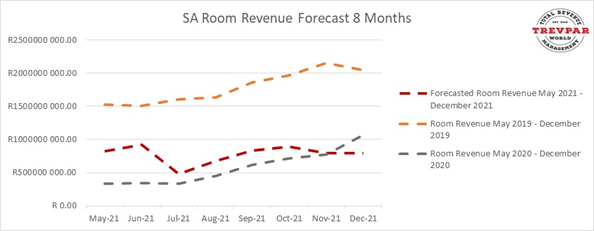

The impact of this lockdown will have a direct impact on the trajectory of the recovery, a steady growth in room revenues would be seen with hopefully a further boost to this with international travel.

When comparing the forecasted May 2021 – December 2021 room revenue figures to that of May 2019 – December 2019 one can see that a decline of room revenue achieved is R8.122 billion (56.68%), this is excluding any other incremental revenue that is associated with with booking a hotel room.

The room revenue achieved in 2019 and early 2020 was the highest room revenues achieved in South Africa in nearly 5 years of trading and we are all in agreement that the goal would be to get back to these levels as quickly as possible. This can only be achieved if fully vaccinated international travel, groups and conventions as well as conferencing is permitted back at full capacity.

Whilst the data at our disposal paints a dire picture of the COVID19 impact and probable recovery trends, it remains exceedingly difficult to anticipate how long it would take the industry to return to 2019 revenue figures.

What is needed now is the continued, collective, and collaborative lobbying for a more expedient vaccination roll out locally as well as lifting of travel advisories and restrictions in order to maximise demand. Trust in travel also needs to be restored and a combination of these will allow us all to navigate more closely to the slow road to recovery.

– ENDS –

Data contained in this article has been sourced from multiple sources and includes data from: STR, LLC / STR Global, Ltd. trading as “STR”

ABOUT TREVPAR WORLD

TrevPAR World, founded in 2016 by revolutionary entrepreneur, Derek Martin, is a hospitality data analytics company that specialises in data driven total revenue management and scalable distribution technologies through a myriad of global partners. The Group offers full-service solutions for commercial readiness including total revenue management, GDS connectivity, central reservations, content marketing, and social media services.

The Groups’ core focus is to optimize property profits by implementing unique strategies that allows owners and operators to track, adjust and improve all performance metrics of their property and all its outlets, in the short and long term.